The Montana Department of Labor & Industry’s Business Standards Division implemented public comment guidelines for its professional and occupational licensing board meetings August 1, 2022.

The purpose of the public comment guidelines is to provide a consistent approach and expectation for public members who want to comment during board meetings. The change in approach affords public members the ability to take part in their government while balancing the board’s need to conduct its business in a timely fashion.

What are the primary changes?

At the beginning of each meeting there is an opportunity for the public to comment on matters which are not on the current meeting agenda. The board cannot act on or discuss items not on the current agenda. The board may direct staff to put an issue brought forward from the public on a future meeting agenda.

The public may comment on an agenda item during the public comment period for each board action item. Each meeting agenda will reflect this time after the introduction of a topic. If there is no public comment, the chair or presiding officer may immediately close that item’s public comment period and proceed with the meeting. The chair or presiding officer may limit comments to proceed with the meeting as well. Once the public comment period is closed, the public may not provide further comment during the remainder of the agenda item discussion, unless specifically requested by the chair or presiding officer of the meeting. Written public comments may be submitted and are encouraged.

How do I submit my public comments?

Please submit your written public comment(s), related to an agenda item, no later than seven (7) days prior to a scheduled board meeting. In your comments, please include your first and last name, and what organization you are representing, if you are representing one. Please also specify what agenda item you are commenting on, or if it is a general comment for consideration. Keep your comments direct and detail the issue(s) you want to bring to the board’s attention. Comments unrelated to an agenda item may be submitted at any time and are encouraged.

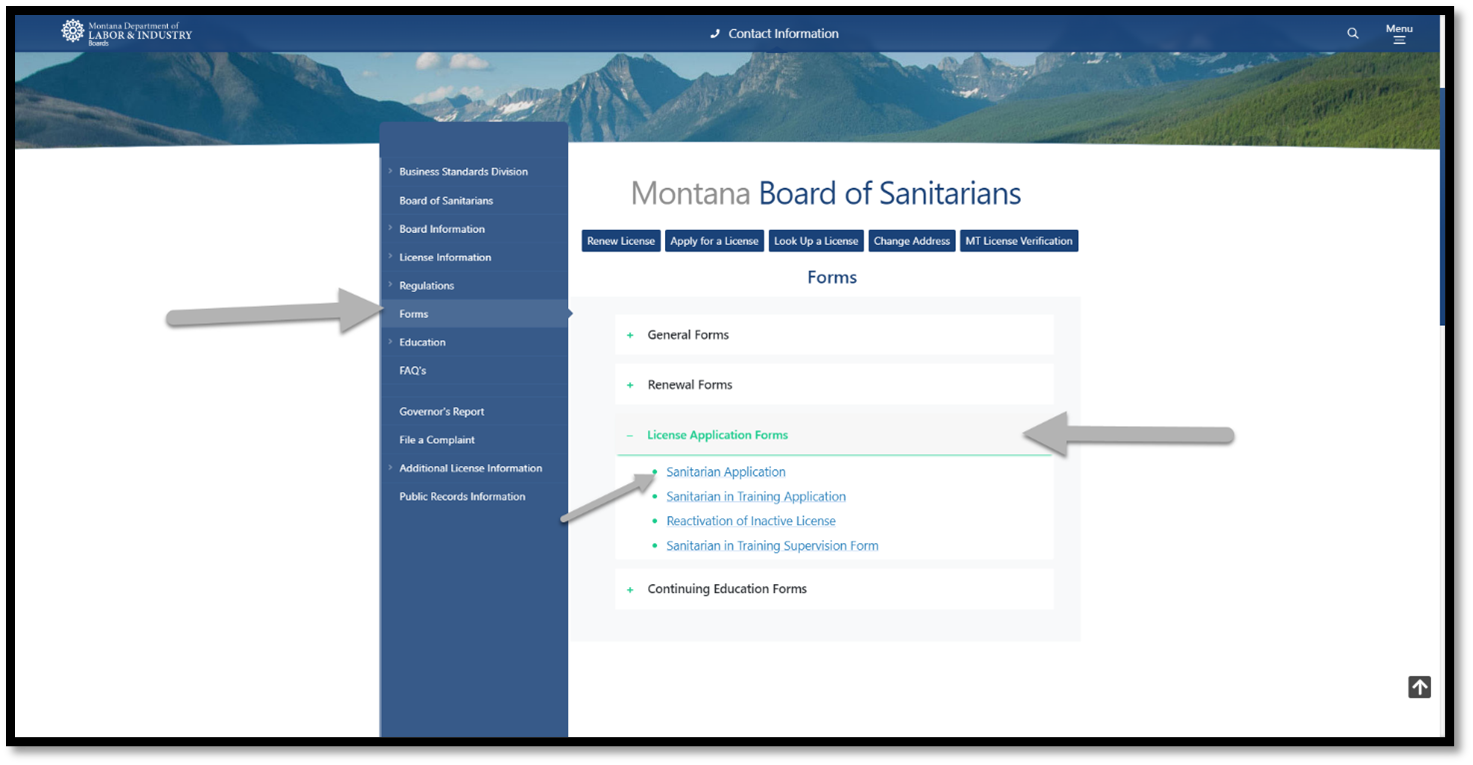

Written comments can be submitted by email either to the board’s executive officer or board specific inbox. Contact information is located here; simply navigate to the appropriate board and scroll to the bottom of the webpage where contact information for each officer and inbox is located. If you have further questions, please reach out to the executive officer of the board you are interested in.

Please see the Public Comment Guide and FAQ below for more specific details: